Toner News Mobile › Forums › Latest Industry News › How Buybacks and Dividends Are Making CEOs Even Richer

- This topic has 0 replies, 1 voice, and was last updated 8 years, 9 months ago by

news.

-

AuthorPosts

-

newsKeymasterHow Buybacks and Dividends Are Making CEOs Even Richer

by Alex BarinkaBuybacks and dividends are rising to records in the U.S., and for many chief executives, that means a fatter pay check — even if sales aren’t growing.

Eleven of the 15 non-financial U.S. companies that spent the most on buybacks last year base part of CEO pay on earnings per share or total shareholder return, or both, according to data compiled by Bloomberg. These metrics get a boost when businesses return cash to investors, giving companies like International Business Machines Corp. and Cisco Systems Inc. added incentive to dole out cash to stockholders.

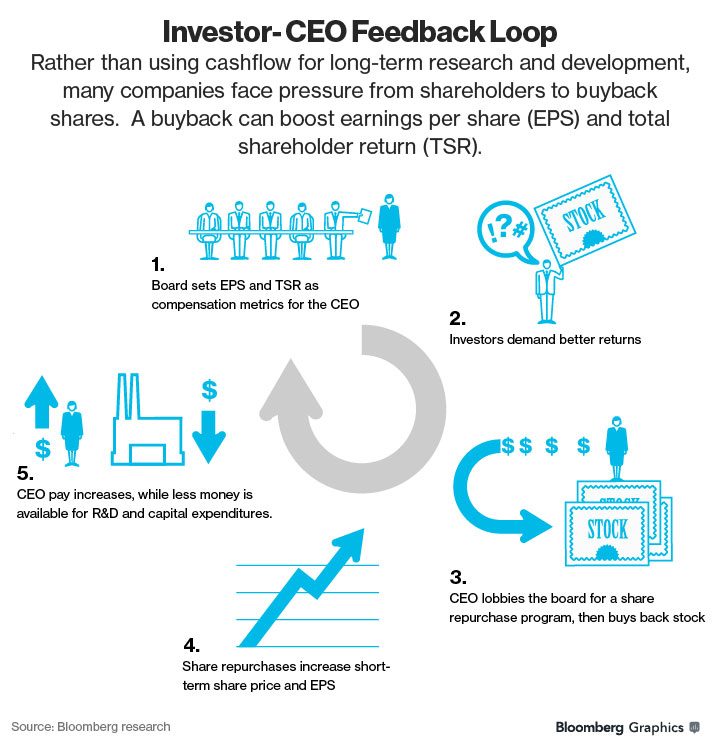

Linking compensation to buybacks and dividends can encourage managers to sacrifice funds that could be used for long-term investments, economist William Lazonick said. It also raises the prospect that executives are being paid for short-term returns rather than running a business well.

“A lot of people are making money without actually creating value,” said Lazonick, an economist who focuses on innovation and economic development and has written about the economic effect of buybacks for the Harvard Business Review.

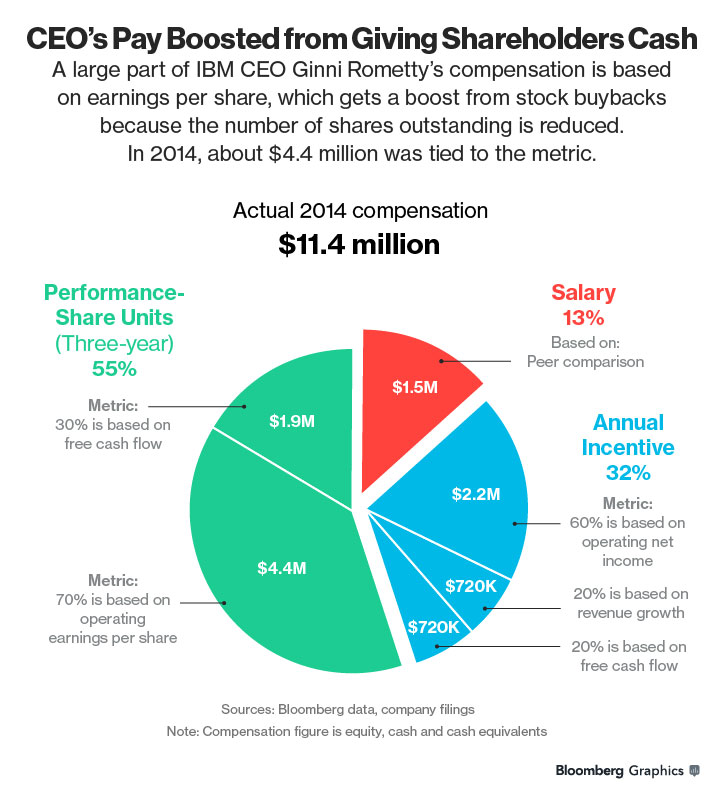

At IBM, almost 40 percent of CEO Ginni Rometty’s $11.4 million compensation package last year was based on operating earnings per share, according to the company’s proxy statement. By contrast, Intel Corp., Hewlett-Packard Co. and Oracle Corp. don’t use earnings per share to remunerate leaders.

IBM drew criticism from analysts and investors last year for what they considered excessive share repurchases. The company returned more than $13 billion, the fourth-largest amount in the U.S., while it was struggling to reinvent itself to a provider of cloud services. In 12 straight quarters of year-over-year declines in sales, IBM boosted operating EPS in nine quarters — with the help of buybacks.

The company has this year reduced planned buybacks to about $6.3 billion in 2015, the lowest level in 11 years.

“There might be some distraction on the incentive side,” said Todd Lowenstein, who helps manage $16 billion at HighMark Capital Management Inc., which holds shares of IBM. “It’s lopsided and skewed toward short-term EPS.”

Ian Colley, a spokesman for Armonk, New York-based IBM, declined to comment beyond the company’s proxy statement.

Shareholder Friendly

Tying pay to performance has long been considered a shareholder-friendly move that gives executives an incentive to ensure that the company is on solid footing. Investors such as Warren Buffett have applauded payouts when they consider shares to be undervalued. Large pension funds have welcomed pay incentives, like when Walt Disney Co. in 2013 changed the way it calculates CEO Bob Iger’s stock awards.

Yet dividends and buybacks can prop up per-share earnings and total shareholder return — lifting CEO pay as a result — even in cases where sales are falling.

The focus on shareholder value has “led to this really corrosive feedback loop between executive compensation and corporate behavior,” said Nick Hanauer, co-founder of venture capital firm Second Avenue Partners LLC. “When everyone around a board room can justify essentially any behavior to generate a higher stock price, no stone shall go unturned.”

Johnson & Johnson shows that it’s possible to use earnings per share as a metric, while capping the impact of buybacks on the CEO’s paycheck. The drugmaker excludes share repurchases, as well as other one-time occurrences, from pay calculations if they increase earnings per share by more than 1 percent.

Besides IBM, other technology companies that use EPS to calculate executive pay include San Jose, California-based Cisco and Xerox Corp. Like IBM, both posted sales declines in their last fiscal years.

Outgoing Cisco CEO John Chambers, who was paid $16.5 million in the year ended July 2014, also got rewarded for boosting total shareholder return, which was added to his pay calculation since 2012.

Last fiscal year, Chambers doled out $9.5 billion on stock repurchases, the eighth most of non-financial American companies. Sales fell 3 percent in the period, the first drop since the financial crisis, amid stiffening competition. Chambers will step down this month, handing the reins to Chuck Robbins.

“Our compensation program is strongly aligned with the long-term interests of our shareholders,” said Andrea Duffy, a Cisco spokeswoman. The executive compensation philosophy and practice is based on pay for performance, she said.

Sean Collins, a spokesman for Xerox, said EPS is a major component used to calculate the price-to-earnings ratio, which is widely used to value stocks by investors.

“Growth in EPS is an important measure of management’s performance because it shows the bottom-line profitability we are generating for each of our shareholders,” Collins said.

Apple Buybacks

Topping last year’s list of share repurchases, Apple Inc. spent $45 billion as Carl Icahn agitated for the iPhone maker to return more cash to shareholders. The billionaire investor has re-upped his call for more buybacks this year, even as a debate has mounted about whether the company has enough new, innovative products to drive sales growth. Apple paid about $11.1 billion in dividends last year, while spending $16 billion on research and development and capital expenditures.

While Apple doesn’t use earnings per share to calculate CEO Tim Cook’s pay, the company changed the requirement for an equity award Cook received when he took over in 2011. After the change, a portion of the shares would only vest if certain total shareholder return goals were met. Cook’s reported pay was $9.2 million in fiscal 2014, according to Apple’s proxy filing, a year when he increased both sales and net income by 7 percent.

Josh Rosenstock, a spokesman for Apple, declined to comment beyond the proxy statement.

Disney CEO Pay

After Disney shareholders including California State Teachers’ Retirement System opposed CEO Iger’s 2012 compensation, the world’s largest entertainment company modified his performance-based stock awards to ensure that earnings per share would be part of the calculation.

As a result, half of Iger’s performance-based stock award is based on meeting total shareholder return goals relative to the Standard & Poor’s 500 Index, with the rest contingent on earnings per share growth compared with the index. The aim was “to ensure that the program meets the objective of providing clear incentives tied to the creation of long-term shareholder value,” Disney said in a 2013 proxy statement.

Earnings per share now factor into both short- and long-term incentives for Iger, whose reported pay was $46.5 million last year. (Reported pay is disclosed in the U.S. Securities and Exchange Commission-mandated summary compensation table, which may include some awards in the year they’re granted rather than for the year they’re earned.)

Disney spent $6.5 billion repurchasing its own stock last year and more than $1.5 billion on its annual dividend. Meanwhile sales grew 8 percent and net income surged 22 percent.

“The company’s capital allocation strategy is designed to create growth opportunities through investment in existing businesses or through acquisition, and to return excess capital to shareholders via share repurchases and dividends,” David Jefferson, a spokesman at Disney, said in an e-mail. “This balanced approach has resulted in stellar financial results and created significant value for our shareholders.”

Record Payouts

Average CEO compensation for the top 350 U.S. firms by revenue has climbed to $16.3 million last year, according to data from the Economic Policy Institute. That’s up from $15.7 million in 2013.

Overall in 2014, non-financial companies returned almost $1 trillion in share repurchases and dividends. As a percentage of gross domestic product, that’s among the largest payouts on record.

Not all investors are applauding the bonanza.

BlackRock Inc.’s Laurence D. Fink, whose firm is the largest shareholder in many large companies, recently penned a letter to S&P 500 CEOs, urging them to resist payouts to shareholders if it compromises long-term opportunities.

“Corporate leaders’ duty of care and loyalty is not to every investor or trader who owns their companies’ shares at any moment in time, but to the company and its long-term owners,” Fink wrote in the April letter.

The inclusion of earnings per share or total shareholder return in CEO pay is above average for the 15 companies that spent the most on buybacks last year. According to a Towers Watson survey of 2012 proxy statements, one of the metrics, or both, were included in less than half of short-term compensation plans at Fortune 500 companies.

Amid a bull market, shareholders may not be as concerned as they should about the potential boost that buybacks and dividends can give to CEO pay, said Robert Barbetti, head of compensation advisory for J.P. Morgan Private Bank in New York.

“Boards and compensation committees should be thinking very carefully about the incentive plans and objectives that work long term,” said Carol Bowie, head of Americas research at proxy advisory firm Institutional Shareholder Services Inc. “The real question for investors is: Is that use of EPS — and potential misuse of EPS — driving pay packages and payouts that are not really delivering solid long-term value?”

-

AuthorJuly 7, 2015 at 12:00 PM

- You must be logged in to reply to this topic.