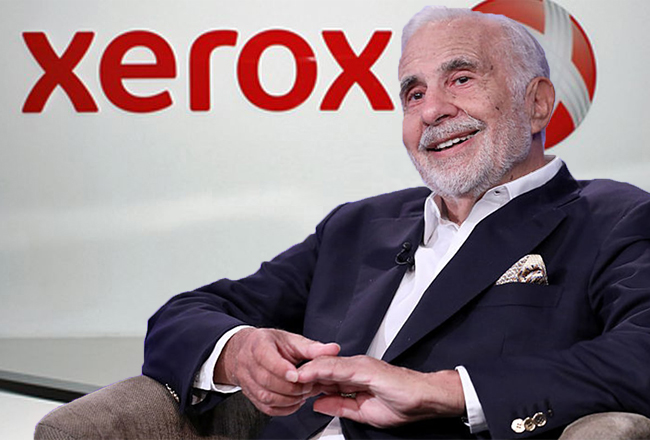

Carl Icahn and banks finalized amended loan agreements. Sunday Icahn Enterprises shares (IEP) jumped 5% in premarket trade. The Wall Street Journal reported that Carl Icahn and banks finalized amended loan agreements Sunday that untie his personal loans from the trading price of his company’s shares. Icahn Enterprises shares have tumbled 43% this year.

The amended loan agreements increase Icahn’s collateral and set up a plan for him to fully repay the loans in three years, the Journal reported, citing people familiar with the matter. That means the only factor that could now trigger margin calls is movement in the net asset value of his investments.

The people familiar with the matter said IEP is comfortable with the asset valuations reported in its public filings.

About 60% of Icahn’s IEP shares were pledged as collateral for the personal loans, which led his lenders to privately call on him to pledge more collateral as the stock price fell. IEP’s stock is down 43% in the year to date and closed Friday at $28.86. Before the short-seller report, it was trading above $50.

Forbes estimates that the incident has cost Icahn some $8 billion in net worth.

Icahn is now putting up about $6 billion in collateral, including $2 billion of his personal funds, and about 320 million IEP shares, said the Journal. The billionaire disclosed to the Financial Times in May that he was using the loans to make additional investments outside of his publicly traded vehicle.

“Over the years I have made a great deal of money with money,” he was quoted as having said. “I like to have a war chest, and doing that gave me more of a war chest.”

Icahn has further agreed to a repayment plan, under which he will pay the banks $500 million in September, make eight quarterly payments of $87.5 million starting a year after that and the remaining $2.5 billion balance three years from now.