Toner News Mobile › Forums › Toner News Main Forums › Ninestar Launches New Automotive Chips Business Called, Geehy Semiconductor Co., Ltd. (says sales will take time)

- This topic is empty.

-

AuthorPosts

-

jimKeymasterDirectly to the shareholders meeting | Ninestar: The sales of general printer consumables are expected to hit a new high, but it will take time for the car chips to get on the car.

Source: Aijiwei/ Article translated to English.

On August 9, Ninestar Co., Ltd. (abbreviation, Ninestar, stock code 002180) held the fifth extraordinary general meeting of shareholders in 2022, on the “Repurchase of Overseas Holding Subsidiary Ninestar Holdings Company Limited”. A number of related proposals such as the Proposal on the Company’s Shares” and “Proposal on the Company’s Provision of Bank Credit Guarantee Lines for Wholly-owned Subsidiaries” were reviewed, and Aijiwei participated in the general meeting as its institutional shareholder.During the meeting, Ninestar communicated with shareholders including Aijiwei on the company’s development and future plans. Repurchase subsidiary shares to improve Lexmark International’s profitability. The topics of this shareholders’ meeting mainly focus on Lexmark International Co., Ltd. (referred to as Lexmark International), a subsidiary of Ninestar Holdings.

The relationship between Ninestar and Lexmark International dates back to 2016. In November of that year, Ninestar Holdings Company Limited (referred to as “Suoda Investment”) was jointly established by Ninestar, PAG Asia Capital Lexmark Holding Limited (referred to as “Taimeng Investment”) and Shanghai Shuoda Investment Center (Limited Partnership) (referred to as “Suoda Investment”). Cayman Joint Venture”) acquired 100% of the shares of Lexmark International Co., Ltd. After the acquisition, Ninestar, Taimeng Investment, and Shuoda Investment held 51.18%, 42.94% and 5.88% of the Cayman Joint Venture respectively. shares.

Today, in order to further promote the development of Lexmark International and enhance the profitability of Lexmark International, and also to fulfill the agreement on the repurchase of part of the shares of the Cayman joint venture held by Taimeng Investment and Schodar Investment in the “Shareholders Agreement,” The twenty-eighth meeting of the sixth board of directors held by Star on January 30, 2022 and the second extraordinary general meeting of shareholders in 2022 held on February 24, 2022 reviewed and approved the “Regarding the Overseas Holding Subsidiary Ninestar Holdings Company”. Limited Proposal for Repurchase of Shares.

After the completion of the repurchase, Ninestar, Taimeng Investment and Shuoda Investment respectively hold 54.30%, 40.20% and 5.50% of the equity of the Cayman joint venture.

Whether it is the acquisition of Lexmark or the repurchase of shares, issues such as financing and capital guarantee are involved. Among them, another proposal involved in this shareholders’ meeting – “Proposal on the Company’s Provision of Bank Credit Guarantee Lines for Wholly-owned Subsidiaries”.

Wu Anyang, secretary of Ninestar’s board of directors, pointed out that Lexmark has also done a major thing this year, that is, the refinancing aspect has been included in the US syndicate. It is more flexible in the operation of funds, and the fees are getting lower and lower.

When acquiring Lexmark International in 2016, Ninestar’s subsidiary applied for a syndicated loan from China CITIC Bank Co., Ltd. Guangzhou Branch as the global lead bank. The syndicated loan was mainly used for acquisition and working capital. In order to supplement the working capital of Lexmark International, in 2021, Lexmark International once again formed a working capital loan syndicate. As of the end of June 2022, the balance of Lexmark International’s existing loans is approximately equivalent to US$1.08 billion, which will be repaid in 2023 and 2024.

In order to solve the repayment pressure of Lexmark International in 2023 and 2024, ensure the liquidity security of Lexmark International in the next five years, improve the guarantee conditions of the existing syndicates, relieve the systemic risk of the company’s guarantee, and reduce the balance of external guarantees, Ninestar adopted Group refinancing in the international market has rearranged the existing syndicated loan. The new syndicated loan is led by Morgan Stanley Advanced Fund Company of the United States , and the project syndicate composed of 12 banks around the world is the lender (hereinafter collectively referred to as “all lenders”). ”) signed the Credit Agreement and the loan was disbursed on July 15, 2022.

The completion of this refinancing enables Ninestar to release the joint guarantee responsibility for the existing syndicated debts assumed by Lexmark International led by China CITIC Bank, and at the same time release the controlling shareholder Zhuhai Sina Printing Technology Co., Ltd. with its 1.26 The stock pledge guarantee provided by 100 million shares of Ninestar, and the unlimited joint liability guarantee provided by the actual controller Wang Dongying for the working capital loans in the existing syndicate.

Lexmark’s sales increase steadily, but it will take time for car chips to get on the car. For investors, they are more concerned about how well Lexmark International, which has been acquired with great effort, is going to be?

According to the latest 2022 interim report forecast, Lexmark International’s operating income in the first half of the year was approximately US$1.16 billion, an increase of approximately 10% year-on-year, and Lexmark International’s printer sales increased by approximately 18% year-on-year.

It is understood that in the first half of the year, the printer general consumables business was affected by the overall economic situation, foreign epidemics and other factors, which should have shown a downward trend, but Ninestar’s business has shown a growth trend.

In this regard, Ninestar pointed out that most of the company’s general consumables business comes from overseas. The gradual recovery of overseas commercial markets has led to an increase in demand. In addition to the appreciation of the US dollar, the overall business has shown a positive trend. The company’s general consumables business has overseas e-commerce sales channels.

Regarding the development status of Lexmark International, Ninestar said that the current hardware sales are in good condition and the supply is in short supply. It is expected to set a record for the highest sales this year. With the further improvement of the supply chain of the printer industry, Lexmark will continue to usher in a sustained high-speed growth in printer sales in the next year. With the mid- to long-term contracts currently in hand, Lexmark’s sales growth is highly predictable. In the past two years or so, Lexmark has updated the entire series of products to enhance product competitiveness. More new products will be launched in the future, and Lexmark has laid a good foundation for future growth.

According to reports, not long ago, the chairman of the company went to the US company to inspect and found that Lexmark International’s product research and development and competitiveness are improving, product performance and cost are improving; the company’s management level has also improved significantly.

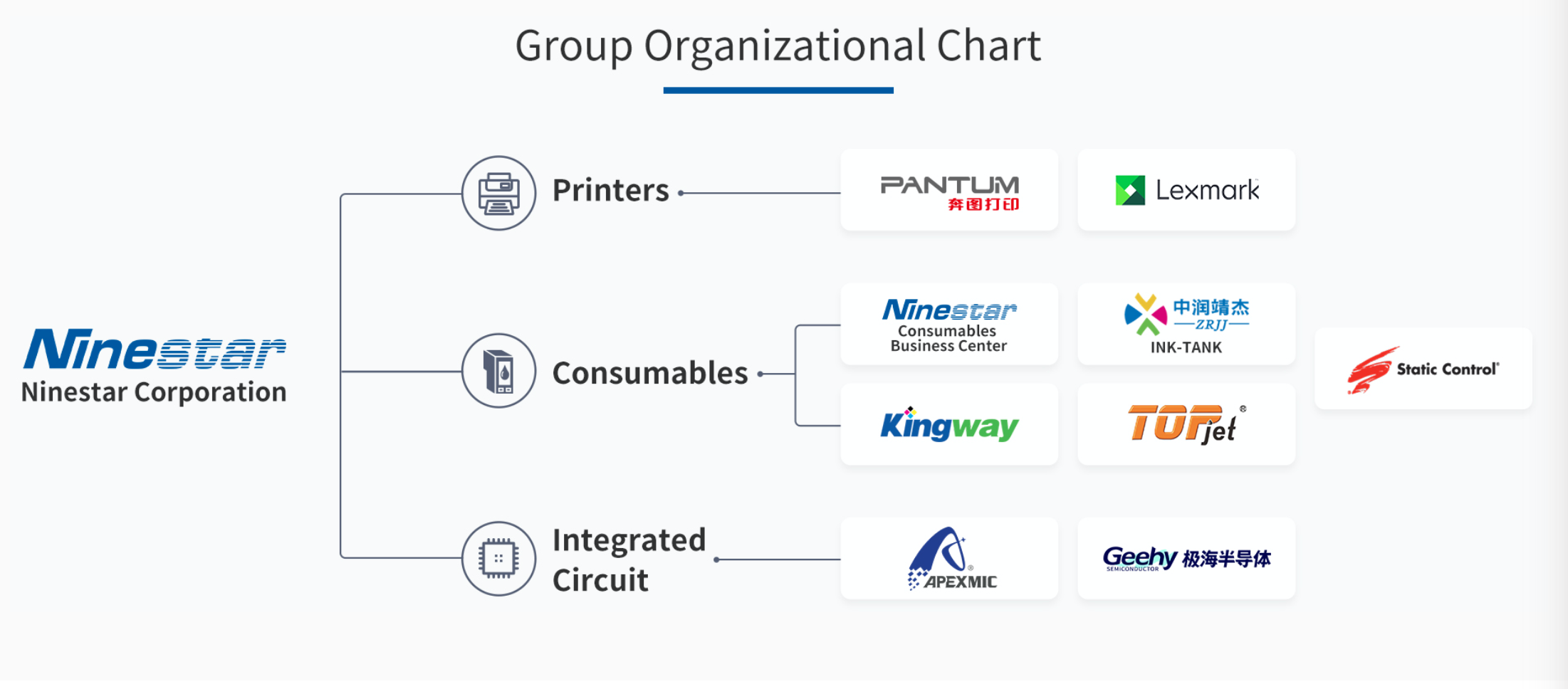

According to reports, Ninestar not only maintains the industry-leading advantage of general printer consumable chips and the first-launch advantage of new products, and consolidates the leading position in the subdivision field, but also actively expands non-printing fields such as automotive electronics and industrial control. “The chip company under Ninestar now has a sales revenue of nearly 2 billion yuan a year.” Wu Anyang pointed out.

Ninestar pointed out that the company cooperated with global R&D centers to tackle tough problems in the industry and further intensified R&D efforts. In the first half of 2022, the company will have a number of MCU chip products that will achieve AEC-Q100 certification. The APM32F072RBT7 MCU product has passed the AEC-Q100 certification of the vehicle regulation in the first half of 2022. At the same time, the ISO26262 automotive functional safety system certification and related new product development are also progressing smoothly according to the progress. “We are all in contact with the mainstream manufacturers in the automotive field, such as SAIC, GAC, Wuling Hongguang and other manufacturers. However, it will take some time for the automotive chips to get on the car.” Wu Anyang added. (Proofreading/Huang Rengui)

https://laoyaoba.com/n/828392

-

AuthorSeptember 4, 2022 at 2:41 PM

- You must be logged in to reply to this topic.